Onderzoek Een vervuild bedrijventerrein, een verlaten haven: gemeenten die een moeilijk stedelijk transformatieproject willen uitvoeren, ondervinden onvermijdelijk problemen met de financiering ervan. Gelukkig bieden innovatieve vormen soelaas, stelt TU Delft-onderzoeker Yawei Chen. Zij keek naar de financiering van vier moeilijke herontwikkelingsprojecten in Shanghai, zoals via private leningen en aandelen, en bespreekt de mogelijkheden hiervan voor de Nederlandse praktijk (let op: artikel in het Engels).

The urban development projects involve diverse governmental and non-governmental organisations. This alliance between the public and private sectors at different scales is crucial in large-scale urban development projects, especially in the neoliberal context. In recent decades, the financial actors and market financial instruments have gained more prominent roles to fill the gap in which public finance used to function. The term financialisation is used to describe the process of “widening and deepening the reach of financial interests” (Pike and Pollard, 2010: 33), and the “growing influence of financial markets over the unfolding of economy, polity and society” (French et al., 2011: 1).

The European Union (EU) identified a number of innovative financial instruments such as the use of loans, guarantees, equity or quasi-equity investment, or other risk-bearing tools. These financial instruments can be combined with grants and involve risk-sharing with financial institutions, or a blending of loans and grants, or can be in the form of development charges or land value finance.

Asian Financial Crisis

Chinese cities have experienced rapid urbanisation and attracted massive investment in the central city through urban redevelopment. As Chinese cities started their ambitious urban (re)development process since the 1980s, most municipalities faced a serious budget shortage. Land leasing is an important revenue for the local state and an important source of investment in urban development and infrastructure projects.

For strategic urban projects, many municipalities turned to the international capitals from non-government sources. These flagship projects are often marketed as promoting economic development from which all will benefit. Nevertheless, local municipalities often face budget shortage if the urban sites under transformation are located in difficult social-economic circumstance or when the development projects were carried out in difficult economic circumstance like the Asian Financial Crisis.

‘Riverfront path with bicycle track between Long Museum and the West Bund Arts Center in West Bund’ door Gina Power (bron: Shutterstock)

World Expo

In the last thirty years, a series of waterfront redevelopment projects along the 113-km Huangpu River were proposed and some have been initiated and carried out. These sites were mainly featured as industrial sites, with the territory isolated from public access and often polluted. As most waterfront development projects take a long period to be implemented, such projects need massive financial investment. The public sector cannot carry out such projects alone, while private investors hesitate to invest in waterfront redevelopment projects due to the high risks. Consequently, these projects have often been experimenting fields with innovative ways of launching and financing such projects.

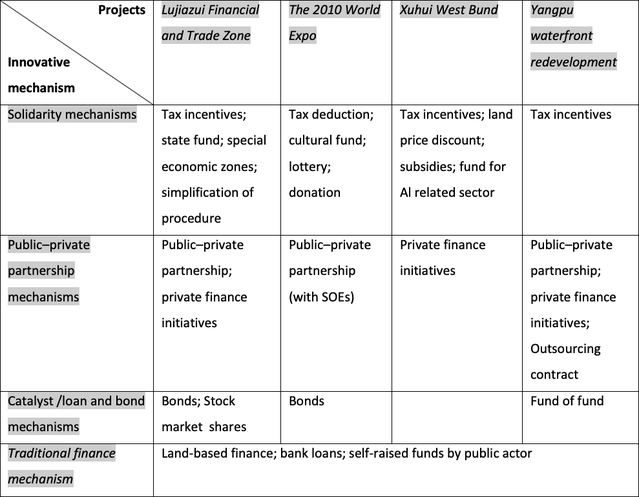

The four cases - the Lujiazui Financial District, the 2010 World Expo site development, the West Bund and Yangpu waterfront redevelopment - adapted the choice of financial instruments to fit own social-economic context and constraints of the time.

The development of the Lujiazui Financial District in 1990 allowed Shanghai to establish its service sector and upgrade its outdated manufacturing sector with advanced technology in the less-developed Pudong, a suburban area on the other side of the Bund area. In comparison, the development of the other three projects came more than a decade later. Shanghai used the World Expo 2010 to develop the host city’s new cultural and exhibition agglomeration and persuade the powerful state-owned enterprises within the site to relocate to suburban areas. The West Bund project is a brownfield redevelopment using the catalyst of the expo event to develop the innovation, cultural and media functions in rich Xuhui District. The Yangpu waterfront had difficulty in attracting developers in social-economic difficult Yangpu District due to the high cost of rejuvenising vacant industrial monuments and poor neighbourhoods. Thus, the strategy Yangpu waterfront redevelopment project adopted was to use a land bank to change the land use on the one hand and combine waterfront redevelopment with innovation and entrepreneurship on the other hand.

Reduce red tape

There are some interesting features in term of innovative financing. First, the four cases explore one or more local government development company to mobilise capital. These companies were established by the local government either solely by a public fund or in collaboration with other public or private organisations. They all follow a diversifying strategy to establish various subsidiaries to help mobilise capital or develop certain sectors the projects envisioned for. They explored public-private partnership (e.g. Lujiazui case) or invited market players to form a consortium (e.g. West bund case) for development. SLDC in the Lujiazui case even went so far as to use the stock market to mobilise extra finance for its projects.

Second, the various innovative financial instruments used were adopted due to the specific economic circumstances, the investment environment of the time, and the legal possibilities provided during the institutional transition. Lujiazui case suffered from the Asian Financial Crisis in the late 1990s. Besides state fund, the most innovative financial instruments were explored in the Lujiazui case, such as issuing bonds to obtain extra capital, borrowing loans from domestic banks and international corporations, public–private partnership. Various policies used in the special economic zones were explored in the Lujiazui case, like tax deduction or exemption policy or a one-stop approval procedure to reduce red tape, to attract investment from domestic companies or focused financial sectors. In the Yangpu case, the urban regeneration fund was used to tap private investment from society. This form of fund of fund was originally used in China to stimulate innovation and entrepreneurship-related project since 2007 but fit well with the vision of Yangpu waterfront redevelopment in combination with the innovation-related sector.

Third, we have seen the financial instruments explored are partly defined by the status of the project and the status of the higher-level administrative levels which the projects’ development companies belong to. Lujiazui case and a large part of the expo case are located in the Pudong New Area, which is developed as a national SEZ and enjoys its administrative status higher than the normal urban district. Both cases received either central state fund or city cultural fund and both explored bonds and stock market for capital, which cannot be found from the other two projects (Chen 2020).

‘Innovative finance mechanisms in four waterfront regeneration projects in Shanghai’ door Yawei Chen (bron: Land Use Policy)

Implication for Dutch urban development practice

The four waterfront redevelopment projects in Shanghai shed some light on what financial instruments can be explored behind each project that was initiated at different historical moments.

Several real estate funding mechanisms were explored, such as the solidarity mechanism (tax-related policy, special economic zone), the public-private partnership mechanism (public-private partnership or private finance initiative), the loan and bond mechanisms (bonds, loans, trusts) across the four projects. The Chinese cases show that innovative financial instrument can provide alternative source at critical moments for urban projects facing capital constrain.

We have observed a number of new players in Dutch urban redevelopment practice, like institutional investors (e.g., pension funds), energy, water health or tech companies or social enterprises. Heurkens et al (2020) described the use of new financial instruments like revolving funds in financing Dutch urban redevelopment projects. The Chinese cases shows the possibilities of alternative financial concepts and instruments in urban development projects. The application of what type of financial instruments depends on the type of projects, the specific economic circumstances, the investment environment of the time, the legal and institutional possibilities. Equally important, the risks involved in the financialization in urban development practice need to be considered and addressed.

Bronnen

- Chen, Y. (2020) Financialising urban redevelopment: Transforming Shanghai’s waterfront, Land use policy.

- French, S., Leyshon, A. and Wainwright, T., 2011. Financializing space, spacing financialization. Progress in Human Geography, 35(6), 798–819.

- Heurkens, E., Hobma, F., Verheul, W.J. and Daamen, T. (2020) Essay Financiering van gebiedstransformatie: Strategieën voor het toepassen van verschillende financieringsvormen bij binnenstedelijke gebiedsontwikkeling [accessed 18 October, 2020].

- Pike, A. and Pollard, J. 2010. Economic geographies of financialization, Economic Geography, 86 (1): 29–51.

Cover: ‘Lujiazui Financial District, Pudong, Shanghai, China’ door Remko Tanis (bron: Flickr.com)